Depreciation may not sound like the most exciting topic, but it affects everyone. Whether you run a business in Abuja, work a 9 to 5 in Lagos, or manage your household budget, understanding how value declines over time can help you plan better and make smarter financial decisions.

What Is Depreciation?

Depreciation is the gradual loss of value of an asset over time. Most physical items like cars, electronics, furniture, and buildings do not hold their original value forever. They wear out, become outdated, or lose functionality. For example, a car bought for ₦18 million may drop to ₦14 or ₦15 million in value after just one year. That decline is depreciation in action.

Why It Matters in Business

In business, depreciation is not just a natural process. It is a ueful accounting tool. Companies use it to spread the cost of long-term assets across the years the asset will be in use. This helps match expenses with revenue more accurately.

For instance, if a printing business in Abuja buys an industrial machine for ₦5 million with an expected life of five years, it might record ₦1 million as an expense each year instead of all at once. This approach gives a clearer financial picture.

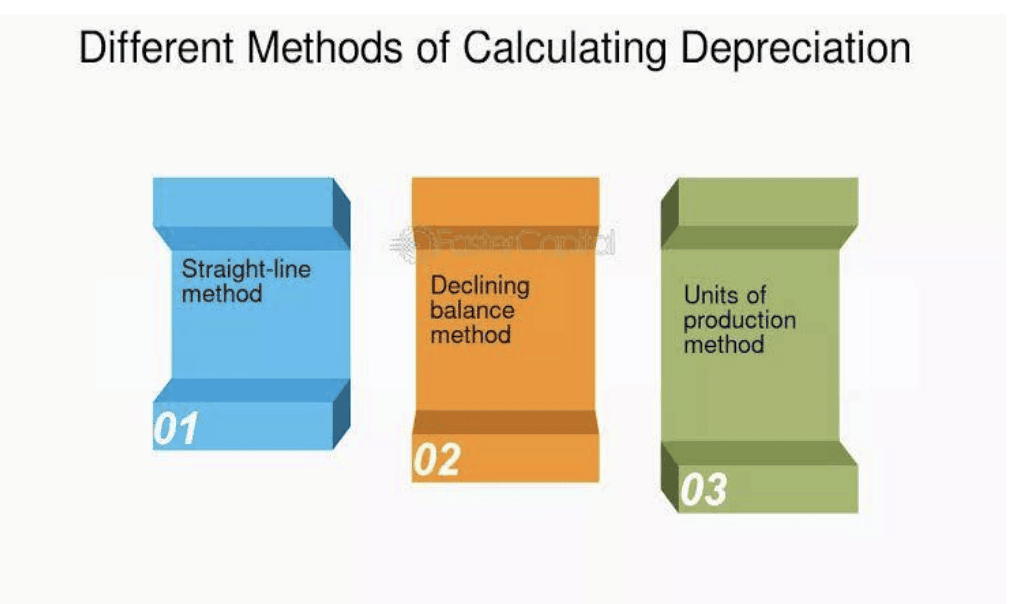

Methods of Calculating Depreciation

- Straight-line method: Spreads the cost evenly over the useful life.

- Declining balance method: Takes more depreciation in early years. Ideal for items like phones or laptops that lose value quickly. For example, an iPhone 14 Pro bought for ₦1.4 million may now be resold for about ₦900,000.

- Units of production method: Based on usage levels. Suitable for assets like delivery bikes or factory machines that experience wear depending on business volume.

Each method helps businesses plan ahead for asset replacement and ensures that records reflect actual asset value.

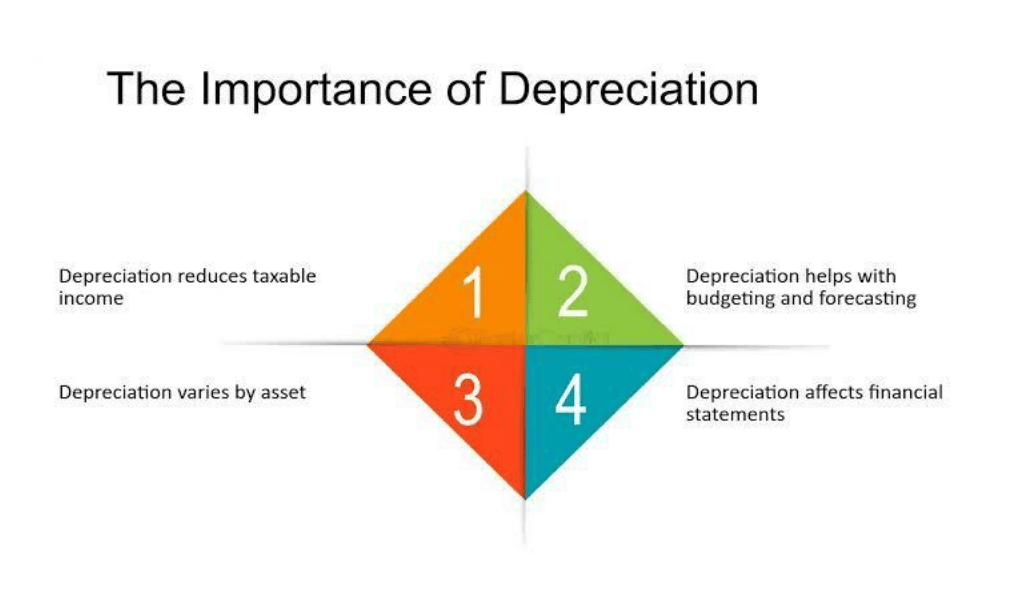

Why Understanding Depreciation Matters

- Accurate reporting: If you own a business, you need to know the real value of your assets. What you paid for that office generator five years ago is not what it’s worth today. Depreciation helps you record a more accurate picture.

- Tax benefits: In Nigeria, depreciation is tax-deductible. This reduces taxable income and frees up capital for reinvestment.

- Personal finance: Depreciation helps when setting fair resale prices for used goods, like televisions or vehicles.

- Better planning: Depreciation is also practical when buying or selling used items. Knowing when an asset is likely to need replacing allows for smoother budgeting and fewer surprises.

The Other Side: Depreciation of Money

Depreciation also affects currency. This is known as currency depreciation or the loss of purchasing power due to inflation. Think back a few years. A loaf of bread might have cost ₦250. Now, it could be ₦900 or more. The product did not change, but the naira lost value. This affects your income, savings, and daily expenses. When your income or savings isn’t growing fast enough to keep up with inflation, you’re losing value without even spending. That’s why money kept idle in a bank account with low interest, or stored at home under your mattress, is silently depreciating.

For example, if you left ₦1 million idle in a current account or at home for four years, inflation might reduce its real value to the equivalent of ₦600,000 in today’s terms. That is why financial planning and investing are essential in today’s economy. Money must grow, not just sit.

Conclusion

Depreciation is more than a financial term. It is a practical tool that helps you understand value loss, plan ahead, reduce taxes, and protect your wealth. Whether you are managing company assets, pricing a used car, or trying to beat inflation, understanding depreciation puts you in a stronger financial position.